Day 15: Employer tax withholding is a scam

Employer tax withholding is a scam used to get people to pay heavy taxes without feeling the pain.

[Employer tax withholding] functions as an anesthetic. It dulls the pain of paying tax, but it also dulls the mind. In Hong Kong, most tax payers seem to have a reasonably accurate idea of how much tax they pay, because they pay it themselves, and the experience sticks in the mind. And the rest of the developed world, in contrast, PAYE decrides the large majority of the population for this opportunity for reflection. - Professor Michael Littleworth

I clearly remember in 2010 when I first became a Hong Kong resident being out with friends...we were at the beach on Ma Wan...and listening to them complain about having just received their Salaries tax bills from the government. This was new to me...coming from the USA and having lived in Mainland China, tax bills were usually about getting refunds, not paying more.

In most of the developed world, employers take money from their employees' paychecks and pay it directly to the government. In Hong Kong, however, employees get paid 100% of their salary and then, only later, at the end of the government's fiscal year, get a bill for the tax owed on their salary.

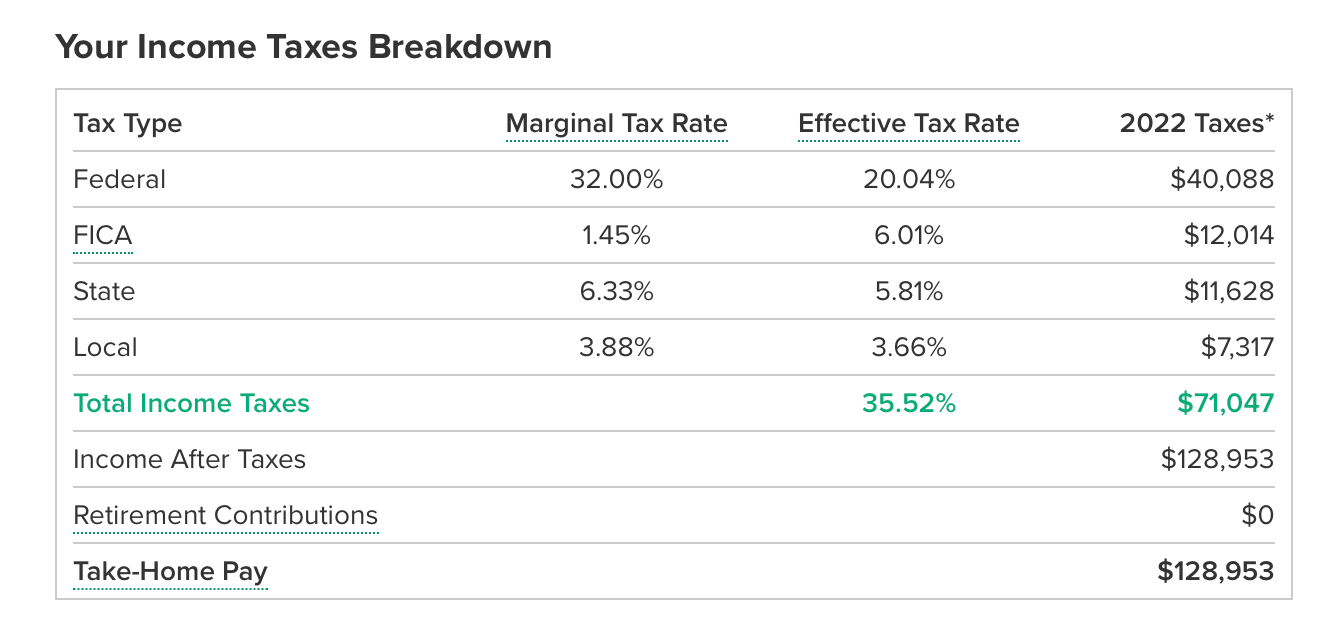

Let's take a look at two employees that "make" about the same about of money. One lives in New York City and has a salary of $200,000 and the other lives in Hong Kong has a salary of HK$1,500,000. Over the course of the year, employee in New York City making $200,000 might only ever see $129,000 of that money enter into his bank account, with the other $71,000 being paid by the employer on the employee's behalf to the government.

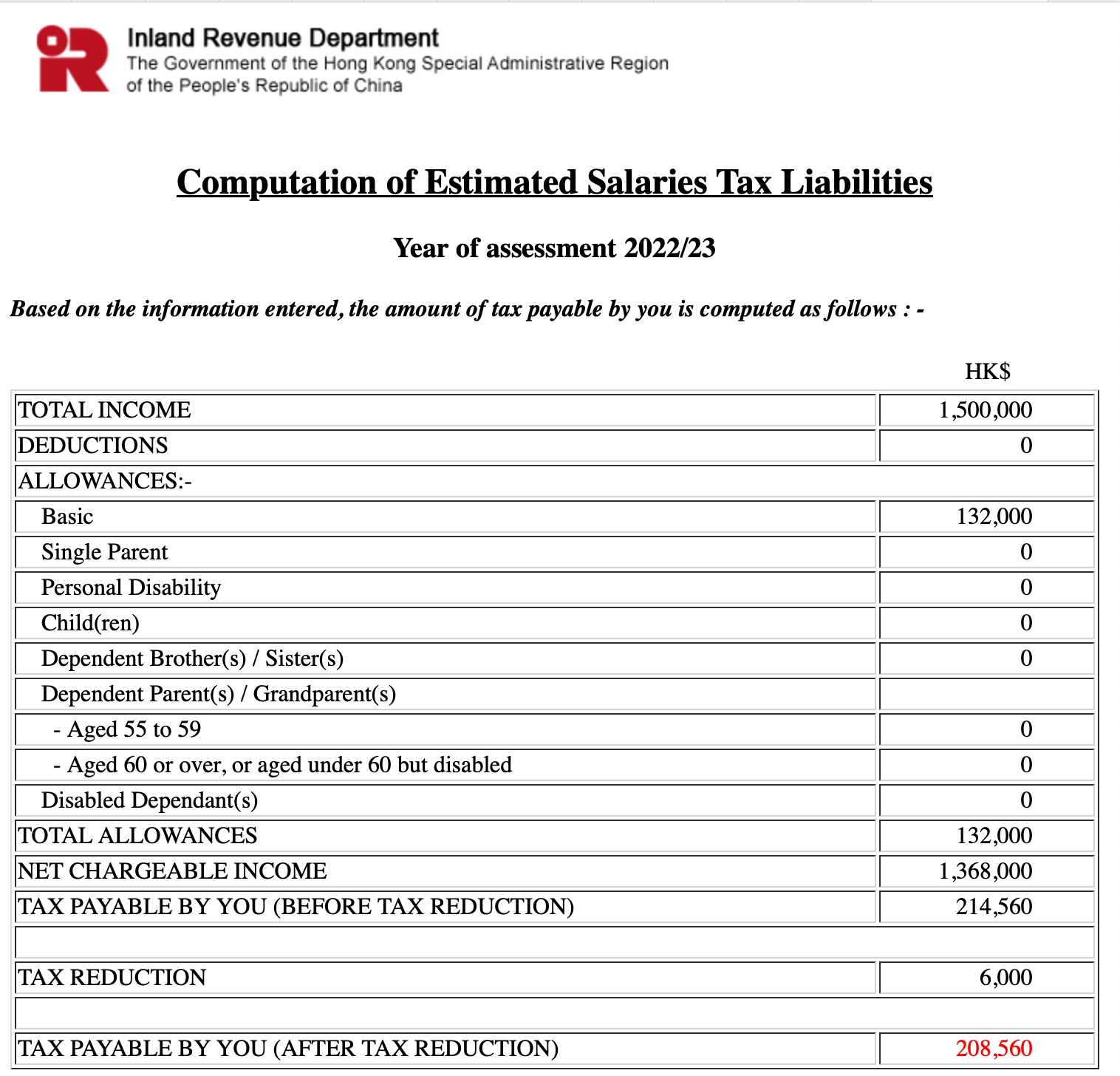

In contrast, the employee in Hong Kong is paid his entire salary of HK$1,500,000 into his bank account over the course of the year. Only later does the government send him a bill for HK$208,560, the amount he owes on his salary tax.

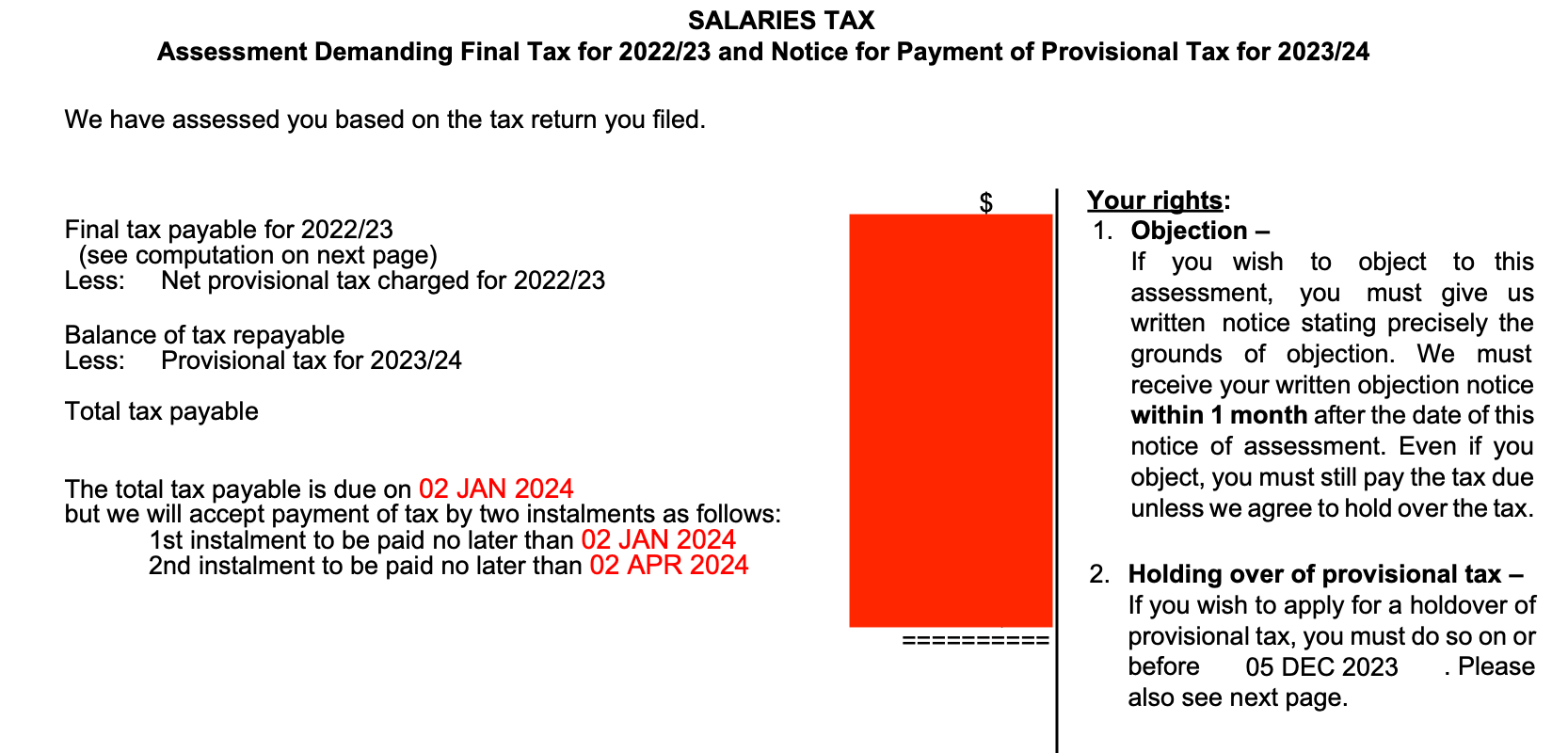

The Hong Kong employee is in the position of writing a cheque for HK$208,560 to the government...a very painful experience. Contrast this to the employee in New York City who never saw the money in the first place and might even be happy to find that he gets a $1,000 "refund" because his employer gave the government slightly too much money.

The psychological difference between these two systems is hard to understate. Governments that use the employer withholding system do so because they would never be able get taxpayers to pay the high rates that they tax them if the taxpayers were given the money first.

Again, Professor Michael Littleworth from around 54:30 of his talk on the History of Hong Kong's Tax Law System:

The reason other countries' [besides Hong Kong] heavy taxes are viable is only because they're collected from the employer rather than from the employee. In the rest of the developed world, if the government were to abolish [employer tax withholding], and taxpayers were required to pay their tax themselves, the result would be that a very large number of them would fail to pay. In order to collect the tax, the government would have to sue the defaulters, which would be expensive. Many would turn out not to have any assets, so getting a judgement against them would be futile. Worse, the political cost of dragging otherwise law-abiding citizens through the courts would be colossal. In short, the consequence of abolishing [employer tax withholding] in most developed countries would be chaos.

Hong Kong however manages very well without [employer tax withholding]. The reasons for this are obvious. Saving to pay Hong Kong's light tax is relatively easy. Also, almost all of those who are obliged to pay are worth suing if they fail to pay. But the fact that the Hong Kong, and the fact that Hong Kong has no [employer tax withholding] gives the Hong Kong government a kind of legitimacy that cannot be claimed by the governments with most other developed jurisdictions. For surely a government that can rely on taxpayer's active compliance is in a sense more legitimate than one whose finances would be reduced to chaos if they tried to do the same.

Professor Littlewood's entire talk is worth watching both if you're familiar with Hong Kong's tax system because you live here and want to know how it came to be or if you live somewhere else and want to know what you're missing.